It is actually essential for borrowers to thoroughly analyze their fiscal predicament, objectives, and also the conditions in their loan settlement when determining whether or not to adhere into the Rule of 78 or examine different repayment possibilities.

For example, as an instance you're taking out a one-calendar year loan with month-to-month payments. Utilizing the Rule of seventy eight, you are able to decide the proportion of curiosity and principal compensated in Every installment. This expertise can assist you make knowledgeable conclusions about early repayment or refinancing selections.

Even if you don’t intend to pay back your loan early, it’s generally a good idea to know how your loan fascination is calculated if you change your repayment strategy.

two. early repayment penalties: Many loans include prepayment penalties, which might be fees imposed by lenders if borrowers pay off their loans ahead of the agreed-upon phrase.

Which means that the fascination is predetermined and fixed in excess of the lifetime of the loan, irrespective of whether the borrower pays off the loan early or helps make excess payments.

During this section, We'll discover the calculation means of precomputed interest, giving insights from unique Views and offering an extensive tutorial that will help you navigate as a result of this complex aspect of loans.

five. Comparative Examination of loan gives: When evaluating diverse loan provides, the Rule of seventy eight can be a precious Instrument. By making use of this rule to the repayment schedules of assorted loans, borrowers can compare the curiosity allocation and overall fascination paid out in excess of the loan expression.

For example, taking on a superior-interest loan may deliver rapid financial relief, but it may lead to the cycle of financial debt Eventually. By analyzing the long-term effect of our fiscal options, we might make much more informed selections that align with our long term objectives and fiscal balance.

When a baby’s economic help deal doesn’t fully include the price of school, many mother and father in The usa can’t only fork out the primary difference, both out in their frequent money or their personal savings accounts.

From the early levels of loan repayment, a bigger percentage of the fascination is assigned, little by little decreasing eventually. Consequently, borrowers who repay their loans early turn out having to pay a disproportionate volume of curiosity in comparison to people that adhere to the first repayment routine.

Previously here mentioned are the "secondary person inputs." They must all be established. During the occasion you are not absolutely sure, even so, you could depart them established to their default values.

D) Transparency and Disclosure: Lenders are demanded to reveal the conditions and terms of precomputed desire loans to borrowers. It can be critical for borrowers to overview the loan settlement and comprehend the implications of precomputed curiosity before committing into the loan.

Loan Total: Enter the total principal degree of the loan. This is actually the quantity that you will be necessary to pay out back again, coupled with any curiosity expenses, over the class of your loan phrase.

Line of Credit history (LOC) Definition, Sorts, and Examples A line of credit history is undoubtedly an arrangement among a lender plus a customer that establishes a preset borrowing Restrict which might be drawn on repeatedly.

Scott Baio Then & Now!

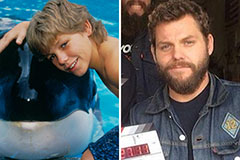

Scott Baio Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!